Table of Contents

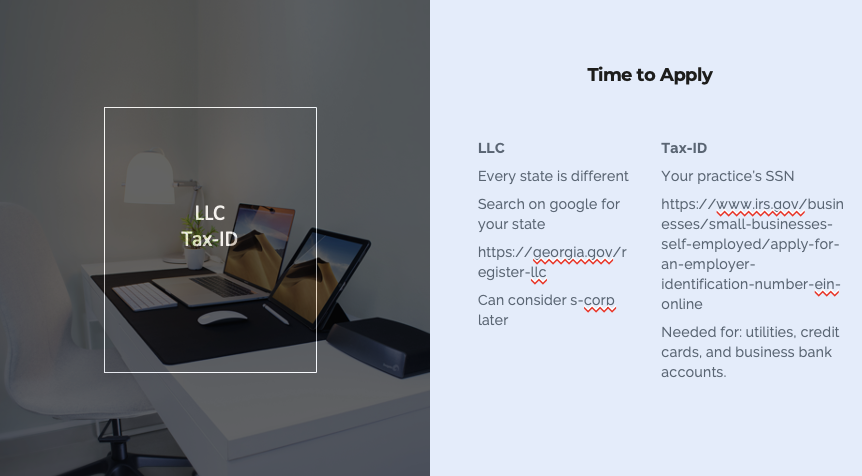

Forming an LLC and Obtaining an EIN is a lot easier than you may realize. This is something that every medical practice will do, and it’s pretty fundamental.

In our last post, we went into detail the pros and con’s about LLCs and C-corps and S-corp tax election. In general, I always recommend forming an LLC. If you are having difficulty figuring out the S-corp election, talk to your accountant. Now, lets actually show how easy it is to form an LLC.

What are the Steps for Forming an LLC?

The first step is to register in your state. Here is the link in Georgia and it goes over some very basic information. https://georgia.gov/register-llc. I found this article to be extremely helpful, and I simply went on google to search for “how to form an LLC in Georgia. Here is another great reference. https://www.legalzoom.com/articles/how-to-start-an-llc-in-georgia

Step 1 – Name Your LLC.

Keep it simple. In Georgia, there are a couple of rules.

Your unique name must include “Limited Liability Company,” “LLC,” or “L.L.C.”

Of course, the LLC name must be unique. It must be distinct from existing businesses (check availability on the Secretary of State’s website).

It also cannot include government agency terms (e.g., FBI, Treasury) and there are certain restricted words (e.g., bank, attorney) which may need extra documentation.

Step 2 – Choose Your Registered Agent.

A registered agent is essentially who is the individual authorized to receive service of process and other official legal documents and notices on behalf of your LLC.

In Georgia, the rules are: They can be an individual (including yourself) or a service entity. They must have a physical address in Georgia. They must be available during regular business hours.

Step 3 – Prepare and File Articles of Organization.

Now it is time to file the Articles of Organization with the Georgia Secretary of State to officially form your LLC.

You have to include a few things such as the LLC name, signature of the filer, LLC’s email and mailing address, Name and address of the filer and registered agent, Names and addresses of organizers

Step 4 – Receive a Certificate from the State

-After approval, you will receive a certificate of organization within five to seven business days, allowing you to obtain an EIN, business licenses, and open a business bank account.

Step 5 – Create an Operating Agreement.

Essentially, at this stage you will draft an operating agreement outlining: LLC’s name, address, and duration, Registered agent information, Business purpose, Member contributions and profit/loss division, Admission of new members, Management structure. Indemnification and liability clauses.

A lot of this is unfortunately tedious and required, but its overall not too bad.

How Do You Obtain an EIN?

After forming an LLC, one of the most important things to do is to form an EIN.

What is an EIN? A business has a specific type of tax ID called an EIN. An EIN is essentially for you to be able to file and manage taxes, open a business bank account, Hire employees

Here is the website to do so. Check out the IRS Websites here and here.

Remember, only the IRS can issue the EIN, and this is free. Any website or company offering you to form an EIN is essentially taking money for you. And remember, the EIN does NOT get discontinued. If you get anything like that, have your suspicious cap on.

With that, you are well on your way to getting your solo practice up. You have found your office, you have formed your LLC, and you have gotten your tax ID.

Next, you should start focusing on funding and getting your equipment ordered and also, credentialing.

Don’t forget to review my timeline post. It does a fantastic job at showing the steps you should be doing things.

Pingback: The Timeline: How To Start a Medical Practice in 9 months